It is simple to gauge what Newcastle United see in the, majority, Saudi Arabia’s Public Investment Fund (PIF)-financed takeover.

Salvation, for a start. This is the break, long desired by supporters, from the disorder imposed throughout Mike Ashley’s rancorous 13-year reign.

The reviled owner, meanwhile, stands to shed this bothersome asset at a time when immense stress on retail caused by coronavirus has cost him, according to The Athletic, an estimated £800 million.

Final approval after a 350-page document was sent to the Premier League is all that awaits before the transaction can complete and PIF chairman Yasir Al Rumayyan will be installed, reports the Daily Mail.

But what is driving Saudi Arabia’s, apparent, desire to add another asset to a sovereign wealth body valued at $320 billion?

Never mind entering a consortium with British property moguls in the Reuben Brothers that the Sunday Times’ Rich List 2019 estimated were worth £18.7bn. Plus, a persistent businesswoman in Amanda Staveley who boasts the magical elixir of contacts and acumen to connect the dots on a fiendishly complex deal valued by the Financial Times at £300m.

Those two parties will hold 10 per cent, each, of ‘Project Zebra’.

The other 80 per cent being held in sovereign hands makes this intrinsically different to, royal adviser and Chairman of General Authority for Entertainment, Turki Al Sheikh’s control of Egypt’s Pyramids FC and Segunda Division’s Almeria. Plus, Prince Abdullah bin Musa’ad bin Abdulaziz Al Saud’s ownership of the Premier League’s Sheffield United which required High Court intervention to become total.

Unlike those endeavours, the might of the Saudi state stands behind Newcastle.

This involvement is about far more than just numbers on a spreadsheet.

—

The Magpies’, probable, rebirth did not begin in earnest when a 31-page charge agreement was lodged at Companies House a fortnight ago. Neither when The Guardian reported a Saudi-financed takeover was “90-per-cent certain” in January.

Their faithful should, instead, rewind the clock to April 2016 and the announcement by – then deputy – Crown Prince Mohammed bin Salman bin Abdulaziz al Saud of his startling ‘Saudi Vision 2030’.

These sweeping reforms, remarkable in their breadth, aimed to rid the Kingdom of “oil addiction “, as MBS told Al Arabiya.

An initial public offering (IPO) of state petroleum company Saudi Aramco and $500 billion NEOM city development have since garnered the greatest interest.

Newcastle represent a drop of oil in the well compared to those schemes.

They wouldn’t even be the PIF’s only recent high-profile purchase. It disclosed an 8.2-per-cent stake in American cruise operator Carnival this month, in another example of opportunism linked to the coronavirus outbreak.

They have also got involved with oil groups Royal Dutch Shell, Total, Repsol, Equinor and Eni, according to the FT.

This is a bargain hunt, on an epic scale. Extracting such value has been given graver importance by Brent crude oil’s descent in value from October 2019’s five-year high of $84.16 per barrel, to last month’s low of $24.93 amid a price war with Russia.

Yet football’s ability to to reach a global audience compared to investment, and the experiences of a trusted regional ally, bear relevance.

—

‘Vision 2030’ is the centrepiece of MBS’s emphatic modernisation drive in the Kingdom.

This force of personality has taken him from being a little known member of the 15,000-strong House of Saud as a child, to becoming a singular presence in the five-year reign of his father, King Salman bin Abdulaziz Al Saud.

The economy is a major facet of the 34-year-old’s all-encompassing grand plan. MBS stated emphatically in the original ‘Vision 2030’ document that Saudi Arabia now possessed a “determination to become a global investment powerhouse”.

Sports and entertainment also featured prominently.

Expenditure in these areas have, largely, moved in one direction; inward.

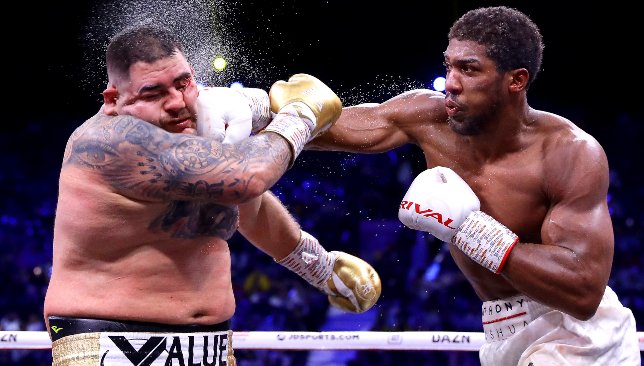

For sport, they include; December’s heavyweight ‘Clash on the Dunes’ boxing bout between Andy Ruiz Jr and Anthony Joshua with purses at an estimated $60m, 2018’s $340m injection of capital into the domestic Saudi Professional League, a lucrative 10-year deal with the WWE for Saudi events, €120m three-year deal to bring the Supercopa de Espana to Saudi, the ground-breaking $20m Saudi Cup horse race, $3.5m Saudi International golf tournament and $3m Diriyah Tennis Cup, 10-year deal with Formula E and high-profile international football friendlies that have featured Lionel Messi’s Argentina.

Andy Ruiz Jr (l) and Anthony Joshua (r).

There are many others.

Only the ‘Clash of the Dunes’, though, can claim true global resonance. A development of strategy was required.

Newcastle represent a headline-grabbing, outwards, break from the norm. Yet they still meet the holistic remit of ‘Vision 2030’.

‘Project Zebra’, the name given by the consortium, would contain significant investment in urban regeneration on Tyneside, plus planned spending on club infrastructure and playing squad.

Last September, the Reuben Brothers revealed plans for a “£200m luxury leisure, shopping and living scheme” in the city centre. They also announced a “multimillion-pound redevelopment of Newcastle Racecourse and High Gosforth Park” in August 2018.

These stand as a sign of what was to come, and where inspiration is derived.

—

Abu Dhabi’s imprint on east Manchester is total.

Manchester City were bedraggled and forgotten prior to Abu Dhabi United Group’s transformational August 2008 takeover, facilitated by Staveley. Their pocket of ‘town’ – as the place is colloquially known – was in an even worst state of disrepair.

Billions of pounds in targeted investment have witnessed thousands of homes built, the historic Ancoats revitalised, ground-breaking Etihad Campus rise up and “noisy neighbours” defiantly usurp Manchester United.

It is City Football Group’s visionary stewardship that has sparked dreams within the downtrodden Newcastle support. This positivity will further extend into the wider community.

Manchester City celebrate 2018/19’s successes.

British government statistics released in October showed 26 per cent of neighbourhoods in Newcastle are among the 10-per-cent most deprived in the country, while the Office of National Statistics’ unemployment numbers for the three months ending in the same month gave the North East the highest percentage in the country at 6.1.

This is a football club and a city in need of help. Without even factoring the ruinous effects of coronavirus.

City’s epochal impact, seemingly, piqued interest in Riyadh.

—

Unknowns, of course, still remain.

Newcastle fans will await the opening of the delayed summer transfer window – whenever that is – with baited breath.

Respected football finance lecturer Kieran Maguire has already estimated that the new owners could “spend £150m, pay decent wages and still adhere to FFP [Financial Fair Play]”.

Intriguingly, UEFA are expected to imminently announce loosening of financial regulations. This may see the Saudis’ plot a turbo-boosted path back into the lucrative – and all-important – Champions League qualification places.

Newcastle last made the group stage in 2002/03.

Allan Saint Maximin (l) in action for Newcastle v Burnley.

City, meanwhile, gained entry in their fourth season of Abu Dhabi-stewardship. They’ve been ever-present since, while 14 trophies have been lifted since the change of ownership.

Newcastle, also, might be able to make a greater impact with less cash than required before coronavirus. Former Bayern Munich president Uli Hoeness last month predicted to kicker that “€100m [transfers] will be a thing of the past for the next few years.”

With long-rumoured interest in Manchester United, seemingly, coming to nought, the Magpies were the next-best-available option for the Saudis.

The blueprint has been set. Can they repeat it in the north east of England?